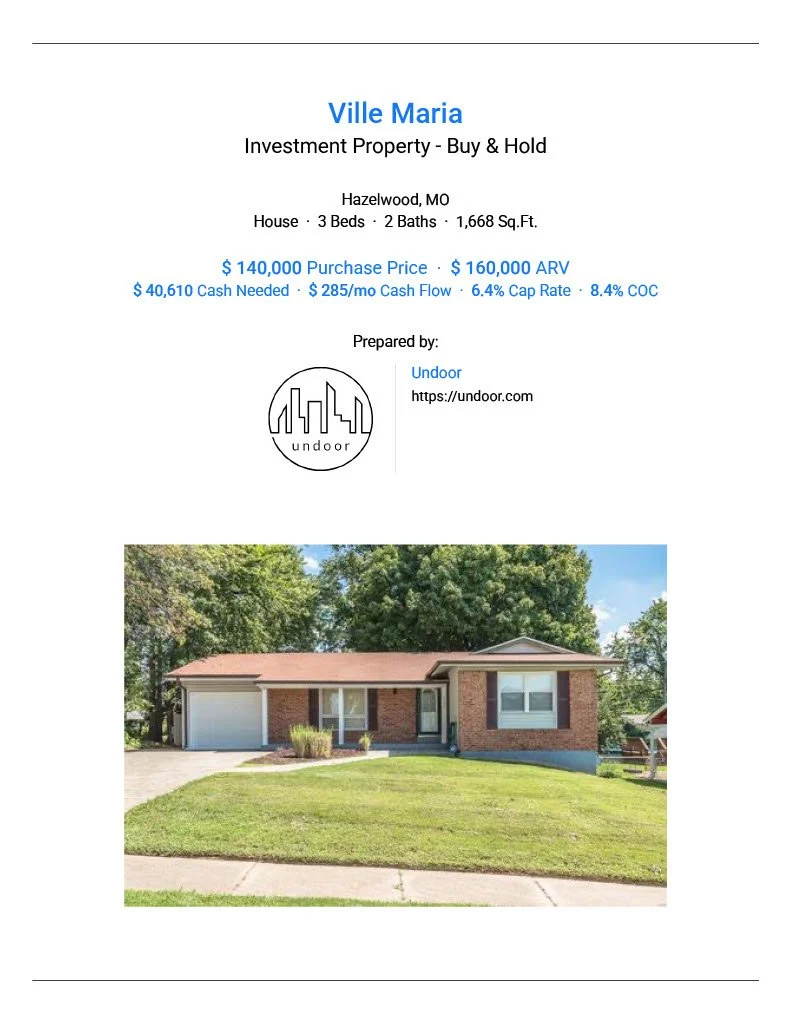

Latest Acquisition & Analysis - Ville Maria - St. Louis, MO

Here is the latest Undoor acquisition, details and analysis!

Deal Highlights

Single Family - 3 bed - 2 bath - 1,668 sqft - MLS listing

Purchase Price: $140,000

ARV: $160,000

Monthly cash-flow: $285

Cash on cash: 8.4%

Deal Details

View the full analysis here. (Use code UNDOOR when signing up for dealcheck.io to get 20% off!)

A bit more for the interested. We noticed this property come back on to the market, meaning it had already been under contract and did not sell. We really liked this property because it had a new roof & gutters, new HVAC, new garage door, new water heater, new electrical. The property already had a clean city occupancy inspection report. We know the neighborhood with its better schools, and own several rentals around here. This property is in better than average condition. Given all that, we contacted our agent as soon as we saw it come back on as we wanted to have first mover advantage. That paid off.

The negotiation process on this one was tricky. Initially, the seller accepted our below-list offer. Before signing their part of the purchase agreement, they went back to our agent saying they wouldn’t take anything less than list price as it had received multiple above-list offers in a matter of hours the first time it went on market. We agreed to offer list (our numbers still worked) if they covered our closing costs. The seller agreed.

The inspection came back with some new findings. The biggest, and really only concern, was the finding around plumbing in the house that needed some repairs. It was relatively significant job that we had quoted at $5,000. Bringing this back to the seller, we gave them 3 options:

do the repairs before the sale

bring the purchase price down $10k (larger amount than repairs since we are leveraging, we do not make up the total repair costs)

we pull out of the deal

The seller went for and agreed to option 1 and do the repairs themselves. 24h later, the seller came back to our agent saying they had changed their mind and no longer wanted to do the repairs and wanted list price. Since they were not in a place to negotiate, we decided to mile the inspection contingency clock as much as we could, knowing that it would increase seller pain, especially if we pulled out and they would have had to list the property for a third time.

This is where our agent and property management company became creative. Right before the inspection contingency expired, my agent went back to the seller to ask for an additional $4k concession. Since we had already maxed out on the amount of seller credit we could apply to our loan closing costs, our agent suggested we have the seller credit the additional $4k as repairs payment to our property management company. That $4,000 will sit in our property management impound account and will be applied to the repairs that we will take on. We totaled $6,300 in seller concessions on this deal.

On to the next one.

What We Learned From This Deal

Good deals can come from quickly jumping up deals that come back on the market.

People are people and they change their minds. A lot.

When you have great team, we can work out creative solutions.

Detailed Property Analysis

Use code UNDOOR when signing up for dealcheck.io to get 20% off!